Mickey Mouse is a Cord-Cutter

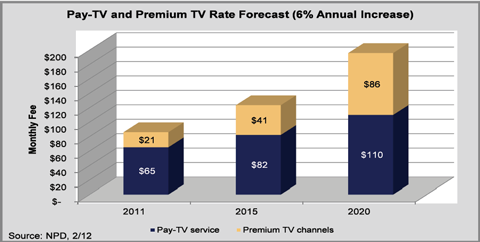

Why pay $80 a month for cable, when you can meet Prince Charming for just $7.99? We all know that Prince Charming would not need to ask for a long term commitment, because he realizes that if it is a good relationship. You will never leave. Cable companies were hoping to make you feel like you had […]